Are You Headed The Right Direction In Market Trading?

The way to make money in market trading is to be heading the right way. If the market is heading up, we want to buy low and sell high. If the market is moving down, we want to have sold to enter (short) and buy it back lower. Overall, the theme for market trading is, “Buy low and sell high, and not necessarily in that order.” This includes shorting the market, which is a powerful way to make money when the markets are falling, retreating or retracing downwards. Uptrends and downtrends are an important “101” part of trading education.

Most people don’t have a trading system in place to keep them safe. Ninety percent of traders are not sustainable in the long run. Why? They may either be undisciplined or they don’t have a winning system. It’s also possible that they they love to gamble. Many love the thrill of gambling/trading no matter whether they win or lose.

I want to show you a “101” way to get in on the right side of the market. We’re going to use the classic definition used by professional traders for eons.

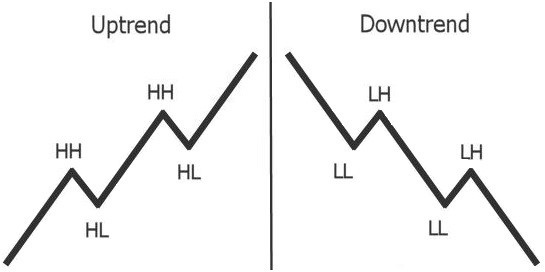

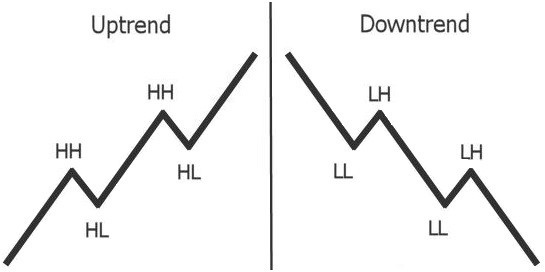

The classic definition of an uptrend is “Higher highs and higher lows”. The classic definition of a downtrend is “Lower highs and lower lows”. If we can figure this out, we can increase our chances of being on the right side of the market.

As you can see in the UPTREND/DOWNTREND graphic, as a market is climbing upwards, every pullback is being bought up to newer highs. If you are a buyer in an uptrend, it doesn’t really matter where you buy (other than establishing a risk/reward ratio). If you buy the pullback and it is destined to go higher and break a new high, you will be a winner. Only if the market goes deeper and stops the classic uptrend of higher highs and higher lows, would you then be in the market the wrong way.

The exact opposite is true as well for a downtrend.

I personally look for two things: 1. Establish whether we are in an uptrend or downtrend on the time frame that I’m planning on trading. 2. Establish whether or not this uptrend or downtrend has been going for a long time and is overbought or oversold, resulting in a potential turn around. Also, the longer a move has been going in one direction, the greater the risk that it will potentially fail and reverse.

Time does not allow me to teach you on this blog how to distinguish a full trend reversal for a new explosive move the other way, one of my signature trades is called a “TRIPLE PILLAR BOUNCE” which is highly accurate for my technical students. We love getting in on the beginning of a new uptrend or downtrend based on a rule based discovery of reversal. All of my Master Trader students learn this powerful move early in their trading education.

Three Rules I Use To Keep Me Safe:

Rule #1:

Establish if your market chart looks like an uptrend or a downtrend. In an uptrend, there has been a low put in, then a higher high, then a pullback to wholesale prices (probably a Fibonacci number), and then a break of a new high, establishing this is move #1, wave #1 of a new uptrend. Look at the SPX daily chart #1 that I’ve posted from October 2021.

We can establish that after downward lows, an uptrend develops with a high, a pullback and a new higher high. There are different ways to play this. Some would buy the breakout of the new high. Then they would ride wave #2 upwards (getting out at a pre designated target). Some would wait for the next pullback to get in on wave #3. The farther up the line you wait to get in, the higher the risk of suffering a losing trade.

Typically, my personal best risk/reward trade will be to catch wave #2 of the uptrend. Why? There are many reasons, but technically speaking, Elliott Wave theory says that there should be three upward waves in an uptrend, followed by two downward waves. Then the uptrend may continue if the season is right for long term upward movement. If this is true, then wave #2 is the safest wave to catch rather than wave #3.

Even if your new-found uptrend is really only a retracement of a bigger downtrend, according to Elliott Wave theory, you should still have at least two total waves up before heading back downward. So again, wave #2, move #2 still gives you an opportunity to get into profit whether you’re in a true uptrend, or only in a retracement upwards before continuing downward.

Rule #2:

The key to trading this style will be to find out, as early as possible, when a trend is starting. If you can see the new uptrend (higher highs and higher lows), then you will be ready to trade wave #2. If you can’t see it, you might be late to the party with higher risk, trading wave #3 (if there is a wave #3).

My students have a sure fire way to see the new move as it is developing. But there are many ways to learn this. Find the transition education you need for trend reversal. Then you’ll be ready to trade wave #2.

Rule #3:

Be careful when you see higher highs and lower lows. When you see this, something is really, really wrong! I call this season #3, hurricane season, whipsaw season. (See my video on three market seasons HERE.) Don’t get caught in a higher highs and lower lows season. This whipsaw/hurricane season will rip you to shreds. Your typical trading system will not work, and this season will reduce your overall winning effectivity by 30% or more.

This Season Three drops an unknowing person’s success rate from 80% down to 50%. It takes a 60% success rate to a meager 30% success rate. Learn the market seasons at all costs!!!

Did This "Trading Market Trends" Education Help You?