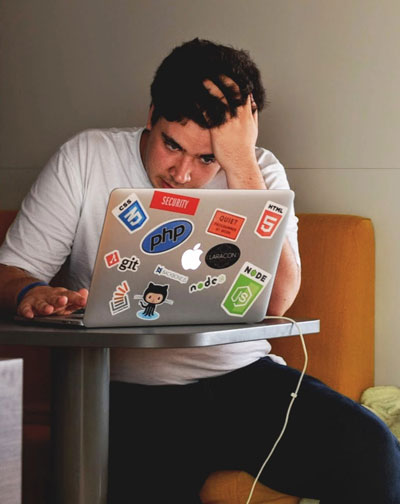

Investing and trading in any market can be a very stressful and emotional thing. Why? Every mental variable converges in your personal trading of any market. These variables include pride, ego, the need to be right, the need to be accepted, successful and valuable, experiencing typical market fear and greed, and so much more. For many untrained market investors and traders, we are a bag full of raw emotion, and those emotions can easily take over whenever we’re ready to buy or sell in any market. When we win, the euphoric endorphin rush hits and it’s time to celebrate. And when we lose, depression can set in, we question our trading abilities, and we begin to second guess everything with fearful unrestrained mental energy. This is EXACTLY where the market wants us.

I have come to learn over decades of trading that I am deeply attached to my money through my emotions. I have found that “my money is me, and I am my money.” Every dollar I earned was gotten through blood, sweat, and tears. That money totally represents (re-presents) my life, time, and energy that I spent to get that money. Those dollars I have in my hand were exchanged for a piece of me that I can never get back. I AM wrapped up in that money, which I am about to put on the line to win or lose in the markets.

Therefore, when I put those dollars on the line with a fast-moving day trade, or a slower moving investment, I am putting “ME” on the line. And I really want “ME” to expand, increase, multiply and grow.

Digging deeper into our psychology, we can find issues that we all have, such as the need to be right, ego, pride, and fear of rejection if we are wrong. These are super powerful emotions that can arise when your trade starts going against you. “Oh no! I can’t be wrong. What will my wife think of me? What will my co-workers say about me knowing that I lost on that last trade?” There are so many fearful emotions that come into play when a trader is untrained, inexperienced, and hasn’t addressed these emotional issues head on.

Trading any market is a deeply psychological event. Endorphins can rush in when you’re a winner, and depression can set in when you are a loser. Fear and greed are rampant, along with our personal emotional hindrances obtained and gathered over a lifetime of ups, downs, and emotionally impacting events.

As a note, I dig heavily into the emotions of trading with my Master Trader class students. They MUST realize what they are about to face when they start trading on paper, and then with live money. The emotions must be completely taken out of the way and silenced if a trader is going to be sustainably successful. This is not an easy task to face and overcome. It’s almost like receiving psychological counseling from your mentor. Everyone is different, but everyone can beat the psychological hindrances to trading with proper training. Become a Master Trader HERE. It will change your life forever and cause you to see your investment and trading future in a completely different way. It will free you to be right or wrong with each trade, without suffering emotionally.

When I was just starting as a market trader, I went through a couple of years of massive emotional highs and lows. I never had anyone train me to overcome my emotions, or how to silence them while day trading the E-mini futures markets. I remember the rush of being right. And I can still feel the pain of being wrong. And when I was wrong, I was REALLY wrong! Why? I would stay in a trade too long, knowing it would eventually turn around in my favor. Why? Because I couldn’t afford to be wrong. I needed to be right. I wanted my closest friends and family to love, accept and cherish me as a good, solid trader who was always right. And for those fearful emotions, I paid a heavy financial price. This is a price that I hope you will never have to pay. Get trained now!

When your emotions start overtaking your psyche, it’s “GAME OVER” for your trading. And this is exactly where the market giants want you. Scared, fearful, and greedy players are easy to milk for everything in their account.

I remember a time when I was so psychologically freaked out over a solid losing streak. I knew that the NYSE was watching me and waiting for me to enter the market. And as soon as I would, it would go against me and take my hard-earned dollars from me. I remember thinking that I should put my wife on a computer facing me, and when I said I was buying, she should sell in order for us to win. WOW – I was really messed up, scared, and in shock at how the market giants were kicking my butt. I was definitely the bait, while the predators were circling and preparing for the kill each time I entered the market. I was second-guessing the trading strategy that I had learned as a beginner, and I was basing many of my entries on raw fear and emotional energy. I was in a position to be eaten alive by the predators of the market.

(Side Note: I have since learned how to become the Predator, where the predators hide, and where they love to attack. I now am a bold, heartless, emotionless, eyes rolling in the back of my head, killer. I am the shark and I know where to attack. You can learn to become a Predator Trader HERE.)

I remember as a new student, losing all faith in my faith. My trading system which I had learned was not a trading system. It was only a bunch of losing ideas that I had learned from an expensive trading course I had purchased. There were no hard rules and my trading education had only gotten me into trouble. The expensive class that I took lured me into the waters, not knowing that the predators were lurking and hungry. No one ever taught me what I learned from experiential and financial loss. So my little seal tail was tattered and torn as the sharks took chunks out of me during the first couple of years of trading.

I then learned to overcome my emotions, to develop a hardened technical trading system that won more than it lost. I learned a hard set of rules that I could follow and submit to which kept me safe and allowed me to win at the end of the day. This education would take me a couple of years to perfect. It was then that I could execute faith that I could survive in the murky, predator-filled waters. Why? I learned the ways of the predator and where they were lurking and hunting. I learned to become a hardened, cold-blooded market predator. And I learned how to follow hardened technical rules that would keep me safe.

I have taught many students through their fears, quirks, and emotions. These people have become successful traders. And most will tell you that the trading education actually changed their entire lives, well past market trading and investing. I know that this is true because my life was also changed by harnessing the power of emotions and keeping them silent during my trading, investing, business activities, social interaction, and every area of my life.

Back in early 2005, one of my students was ready to start trading the Emini futures markets “live” with real money. I remember the morning that he made his first couple of trades. While he won by using my system, he needed me to call him. He said, “Daniel, I don’t know what came over me today. When I entered the trades I was shaking, my palms, head, and neck were sweating, and I felt tightness in my chest. I was a bag full of emotions and I couldn’t figure out what was happening to me.”

I told him that he was experiencing a whirlwind of emotions surrounding those trades. He was putting “HIM” on the line (hard-earned dollars representing his life exchange) and needed to make that trade work, though he was powerless to force the market to do what he wanted it to. He was out of control. He was depending solely on the market trading system he had learned.

He responded, “I have bought lots of real estate in my life. I have signed multi-million dollar deals. I have bought huge properties sight unseen. Then we went out and celebrated with a high-dollar meal and all the festivities. Yet, I was having a heart attack over a $100 trade? This is insane!”

The crazy part of this story is that this man is a very successful pastor and he is a man of great faith. He doesn’t have a problem stepping out and doing something bigger than himself. His faith worked in his customary domain. But he stepped into a completely different domain where he needed to grow his faith and overcome fear and emotion. It was quite a learning experience for him. My hat is off to him for defeating fear and his unrestrained emotions in the marketplace. I walked in his shoes as well. And I am guessing that you may have walked in these shoes too if you are reading this blog.

Without going into detail, I want to give you some advice. Take it or leave it.

- You must learn to rely on a system that’s bigger than you. This system needs to be profitable and it must win more than it loses. This will be a technical system with a long history of success.

- You must learn to submit to your trading system. Each trade you take, you follow the rules exactly as commanded. This takes the pressure off of you and puts it on the system. As long as you follow the rules, it’s not up to you whether the trade will win or lose. The pressure is on the trading system. This will take a huge load off of your emotions.

- You will learn to silence your emotions once you see the system working for you and faith is built in its overall longevity of success. Fear can be screaming at you, but your faith will rise with your trading system and will overcome all fear.

- Never mix fundamental trading/investing with technical. This will cloudy the waters and will shoot holes in the historical success of your technical system. Read my blog HERE on this subject. This is a strong key to true market trading success, in my humble opinion.

I hope this article has helped you. Unrestrained emotions will kill your trading success and set you up for the predators to take you out. Find someone who can help you with your emotions and trading/investing. They are out there, but they are few and far between.

If you’d like to contact me personally, my Whatsapp contact number is the best way as I am international most of the time. I’m usually 10 – 15 minutes from answering with Whatsapp. Look on the upper right side of this page to get my Whatsapp contact information.

– Dr. Daniel Daves

If you are ready to take the collegiate level challenge to become a technical Master Trader, click HERE to join me in the training room.

If you would like to try my “Predator Trader” education to give technical trading a try, click HERE to join. You will love becoming the shark rather than the seal.

Check out my article titled, “Market Trading As A Secondary Stream Of Income” HERE.

Check out my article titled, “Why Technical Trading & Fundamental Trading Don’t Mix” HERE.

Photos: Some photos on this web site are used with permission by Kindel Media:

Disclosure/Disclaimer: Remember that Dr. Daniel Daves is not a licensed investment adviser, and everything that he posts is for educational purposes only. There is no intend to convince you to buy or sell anything in any market. Our full disclosure is located HERE.